Baobab Developments: 2020 Africa Venture Capital and Start-up Investment Report

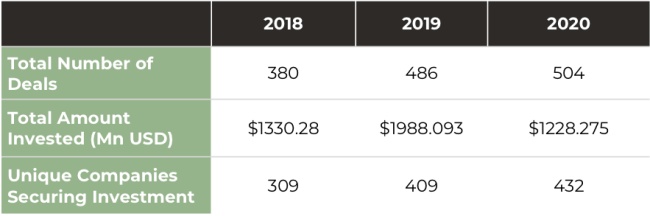

2020 will be remembered as a year like no other. As Governments began to lock down cities and countries around the globe, it felt for a while like everything was placed on pause. Following on from our preview report published at the end of December 2020, start-ups in Africa closed out 2020 in a far stronger position than could have been predicted, with the total number of VC deals increasing from a 2019 total of 486 to 504.

In this report, we take a closer look at some of the key themes and trends from 2020.

Headlines from the 2020 Africa Venture Capital and Start-up Investment Report:

- The total amount invested in 2020 reached $1.228 billion USD across 504 deals, a decrease from the 2019 total of $1.988 billion across 486 deals.

- FinTech continued to attract the most investment in terms of deals (increasing from 112 in 2019 to 115 in 2019) and amount invested (decreasing from $750.4 million USD in 2019 to $391.7 million USD in 2020). However, with services moving online in response to the COVID-19 pandemic, healthcare technology, education and e-commerce sectors also saw an increase in their share of deals (28.9%, 42.9% and 36.8% increases respectively from 2019 to 2020).

- Angel and Seed stage funding saw the largest increase in the number of deals announced (increasing from 306 to 340 deals between 2019 and 2020), both early and late-stage investment both decreased in terms of the number of deals (combined total of 99 in 2019 decreasing to 70 in 2020) and the amount raised (decreasing from a combined total of $1.55 billion USD in 2019 to $632.6 million USD in 2020).