According to a recent report published by the Economist, a news and research organisation, the path to Africa’s recovery from COVID-19 may well be bumpy. While there is some good news; the African Union has secured 670m vaccine doses on top of those promised under the COVAX scheme, there isn’t yet clarity on when these will arrive. The Economist Intelligence Unit, estimates that some African countries will not be vaccinated until 2023.

This is creating a fine balancing act for governments and policy makers between public healthcare demands and negative economic impact. But according to Research Professional News, a data provider, governments across are looking to technology, and more specifically Artificial Intelligence, to help find scalable solutions to both fight the disease and make more informed policy decisions.

Image source: The Economist

Uganda’s Makerere University, is using AI to monitor conversations on public radio to better understand public perceptions regarding the disease, a powerful step in understanding vaccine uptake. The Kenya-based African Population and Health Research Centre will also host two projects; one using AI to study COVID-19 data to support economic policy in Kenya and Malawi, the other to set up a COVID-19 data system. The $12.65 million USD funding for these projects comes from Canada’s International Development Research Centre and the Swedish International Development Cooperation Agency.

Is AI the Cure?

These research projects will play a large part in both combatting COVID-19 and ensuring uptake of available vaccines. But the need for more immediate solutions to both fight the pandemic (alongside other healthcare outcomes) is creating an opportunity for HealthTech start-ups. In our 2020 funding report, healthcare technology companies saw a 28.9% increase in the share of deals.

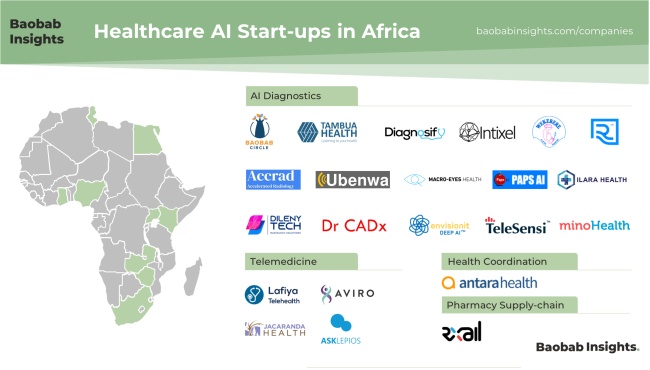

Our analysts looked at companies using artificial intelligence to improve healthcare outcomes across Africa. Broadly, companies fell into four categories; AI Diagnostics, Telemedicine, healthcare coordination and supply chain.

The majority of companies we featured use artificial intelligence to support improved diagnostics. Companies such as Zimbabwe-based Dr CADx, Egypt-based Rology and Ghana-based Diagnosify apply artificial intelligence algorithms to medical images or diagnostic tools. This helps support trained medical professionals to identify disease with a greater degree of accuracy.

Nigerian integrated healthcare tool Lafiya Telehealth, and South Africa-based Aviro Health both employ Artificial Intelligence solutions to empower patients to navigate complex healthcare systems and access care. RX All uses AI to provide a level of authentication onto the healthcare supply chain and combat the use of counterfeit health products.

Healthcare resources in many geographies across Africa is limited, measures such as the number of available physicians per head of the population are below the global average. Therefore, solutions which can both support healthcare professionals to work more efficiently, and enable the patient to access help more independently help to alleviate the burden on primary healthcare providers.

Is Healthcare AI investment lagging?

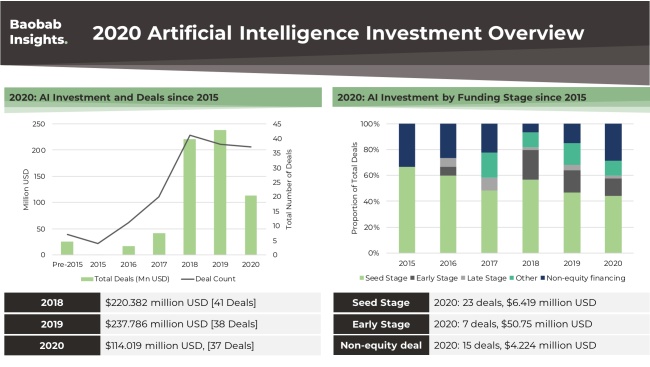

Between 2018 and 2019 the amount of funding secured by artificial intelligence powered start-ups increased from $220.382 million USD across 41 deals, to $237.786 million USD across 38 deals. Along with wider investment trends, funding secured by AI start-ups dropped significantly in 2020 reducing to $114.019 million USD across 37 deals.

Interestingly, the number of Seed stage rounds secured year on year has reduced from 25 deals (totalling $4.182 million USD) in 2018 to 23 seed stage deals in 2019 (totalling $13.975 million USD). In 2020, the number of seed stage deals actually increased across all artificial intelligence companies to 23 deals totalling $6.419 million USD.

While healthcare AI has certainly enjoyed increased attention as a result of the COVID-19 pandemic, companies have steadily been attracting investor attention for some time. The number of deals secured by healthcare AI companies accounted for 7.3% of total AI dals in 2018, this increased to 15.8% of total deals in 2019 and 24.3% of deals in 2020.

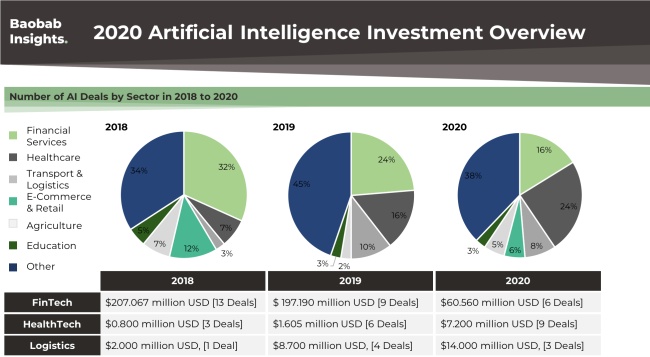

In terms of funding however, Financial Services technology companies secured the majority share of funding over the same period. In 2018 AI-powered FinTech companies secured $207.07 million USD (94.0% of total funding). This dropped to $197.19 million USD (82.9% of total funding) in 2019 and $60.56 million USD in 2020 (53.1% of total funding).

Healthcare AI has seen an increase in funding. In 2018 Healthcare AI secured $0.80 million USD (0.4% of total funding), increasing to $1.61 million USD in 2019 (0.7% of total funding) and $7.20 million USD in 2020 (6.3% of total funding).

Is Healthcare AI coming of age?

As we have seen in our previous reports, the COVID-19 pandemic has certainly thrust healthcare technology companies into the spotlight. However, our analysis indicates that the majority of companies are looking at the healthcare sector more holistically – using AI technology to solve issues across the value chain. This is important, while vaccination may be a long way off, healthcare resources and patients still need support across a range of healthcare outcomes.