In March 2017 the Kenyan mobile money transfer platform M-Pesa celebrated its 10th birthday. The growth in access to mobile money has been reflected in the access to financial services generally, with a greater number of households across Africa having access to formal banking services.

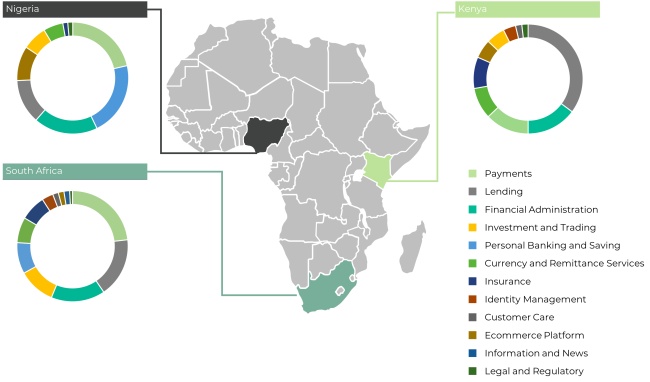

There are a greater number of financial technology start-ups offering a wider diversity of solutions to consumers. We take a holistic view of the financial technology market in Africa to understand how it is developing.