Over the past decade, the major economies of East Africa have experienced significant and sustained periods of growth, this has not translated directly to the insurance industry.

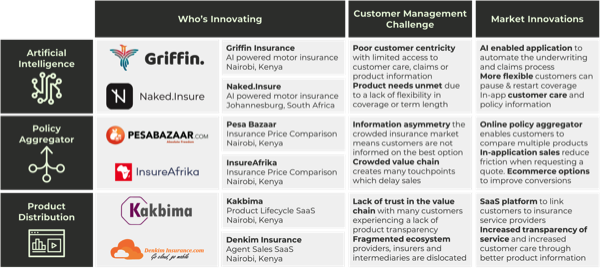

Part of the challenge lies in the balance of providing operationally efficient services to customers while ensuring that costs remain low. In a crowded and competitive market like Kenya, this is creating an opportunity for tech entrepreneurs to bring a fresh approach. We take a closer look at the market drivers and some of the innovative solutions that are putting the customer at the heart of the insurance industry.