Technology companies in the on-demand mobility space have had a tough time in 2019 and 2020; from bans on motorbike and tricycle taxis in Lagos, to driver strikes and the effective shut-down caused by the coronavirus (COVID-19) pandemic. Despite all of this, investment into the on-demand mobility sector has seen quarter-on-quarter investment increase over the past 12 months; from $4.05 million USD in Q3 2019 to $20.4 million USD in Q2 2020.

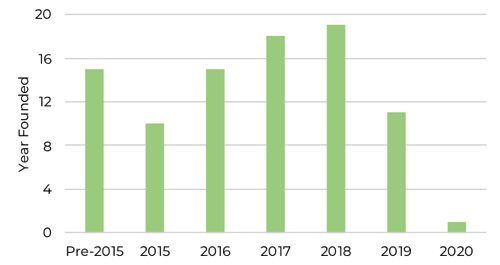

That said, competition is fierce. Large well-backed companies such as Uber and Bolt are jostling for space in a crowded market. Our analysis indicates a reduction in early-stage pre-seed and seed stage deals between 2018 and 2020, with the number the number of larger raises secured by the likes of Swvl, Halan and Max.ng increasing. But as our past reports have shown, the on-demand mobility sector in Africa is creating increasing demand for supporting services such as FinTech and micro-insurance. Perhaps, we are starting to see the emergence of more diversification and smaller B2B services?

In this report we take a closer look at some of the investment trends and companies helping to service the on-demand mobility sector across Africa.