An evolving trend towards ‘Super App’ products in Africa — Baobab Insights asked seven leading market voices to help unpick the topic.

Is the Super App a short-term trend in Africa?

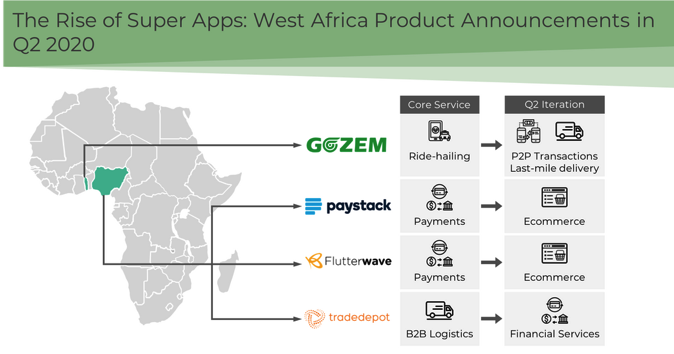

Over 2020, our analysts at Baobab Insights saw a new trend emerge. Company announcements made by start-ups in Africa in the e-commerce and logistics sectors mentioned a raft of new products and services. Specifically, they noticed companies broadening their service offering towards services that are commonly termed as a “Super app”. In our ‘Tracking Tech Developments in West Africa Q2 2020’ report for example — Baobab Insights identified four well-established start-ups introducing new products and services, iterating from their original core service.